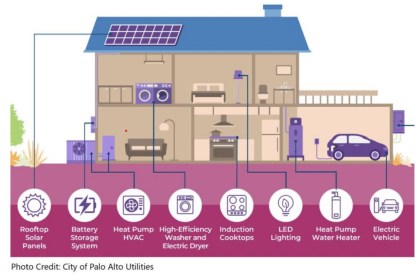

The Inflation Reduction Act (IRA) will yield opportunities for energy savings and greater control of your energy bills at home.

The new law represents a big step forward in making funding available to help utility customers stave off price increases linked to surging natural gas prices in the energy marketplace.

The rebates won’t be available right away because each state must set up a program to manage and distribute the incentives.

While we wait for more details on how the savings will be rolled out, it is clear that there will be more chances to save.

One significant change is a 30% tax credit for battery energy storage, which will take effect Jan. 1. And, the current tax credit for rooftop solar, which was to be phased out, will remain at 30% for 10 years.

With credit to Rewiring America, here’s a quick look at what’s coming available, and when, starting with tax credits and then moving on to incentives/rebates:

Tax Credits

- Rooftop solar, 30% discount, available now.

- Geothermal heating installation, 30% discount, available now.

- Battery energy storage, available in 2023.

- New Electric Vehicle, up to $7,500 discount, available in2023.

- Used Electric Vehicle, up to $4,000 discount, available in 2023.

- Basic Weatherization, $1,200, available in 2023.

- Electric Panel Upgrades, $600, available in 2023.

- Heat Pump AC/Heating System, $2,000, available in 2023.

- Heat Pump Water Heater, $2,000, available in 2023.

Upfront Discounts / Rebates, availability to be determined:

- Heat Pump Water Heater: Up to $1,750.

- Heat Pump, up to $8,000 or 100% of the cost, with highest incentives targeted for low-income households with up to 80% of the average median income.

- Electric Stove, $840.

- Heat Pump Clothes Dryer, $840.

- Electric Panel Upgrades, $4,000.

- Basic Weatherization, $1,600.

- Electric Wiring, $2,500.

- Whole home energy reduction, up to $8,000.

Other incentives and tax credits will be available for businesses to make their buildings more efficient, and for home builders who take the extra step of building energy efficient homes from the get-go. And there are savings for utilities including utility-scale solar, battery storage and other technologies. More on that in a future blog post.

Here are some more resources to check out with information about provisions in the IRA:

- U.S. Green Building Council – provisions related to energy use in buildings and building performance.

- Renew Wisconsin – provisions for renewable energy, EVs and more.

- Rewiring America – an overview that includes an online calculator to obtain an initial guesstimate on potential savings.

- Canary Media – an overview of energy efficiency and clean energy savings opportunities, with a critique of Rewiring America’s calculator.

If you want to read more about what the Inflation Reduction Act may mean for Wisconsin, check out media coverage from recent days and weeks:

- Wisconsin Public Radio: More than 90K homes could install rooftop solar in Wisconsin under Inflation Reduction Act Environmental reporter Danielle Kaeding interview PSC Chair Rebecca Cameron Valcq, Tom Content of CUB and Michael Vickerman of Renew Wisconsin.

- Lake Effect, WUWM, Milwaukee’s NPR: Environmental Reporter Susan Bence interviews CUB Small Business Members Lisa Geason-Bauer of Evolution Marketing, Kevin Kane of Green Homeowners United and Tom Content, CUB executive director, about energy-saving upgrades and the IRA.

- Green Bay Press-Gazette: Business Reporter Jeff Bollier reports on key provisions and what they could mean for rooftop solar and energy-saving upgrades.

- Wisconsin State Journal: ‘A little bit for everybody’: How the Inflation Reduction Act boosts clean energy Energy and environment reporter Chris Hubbuch talks to solar installers, Renew Wisconsin and homeowners who’ve installed heat pumps about some of the changes the law will bring.

CUB will keep you up to date as we learn more about how Wisconsin will be rolling out the new incentives, and how they might sync with the rebates offered through the state Focus on Energy program.

You must be logged in to post a comment.